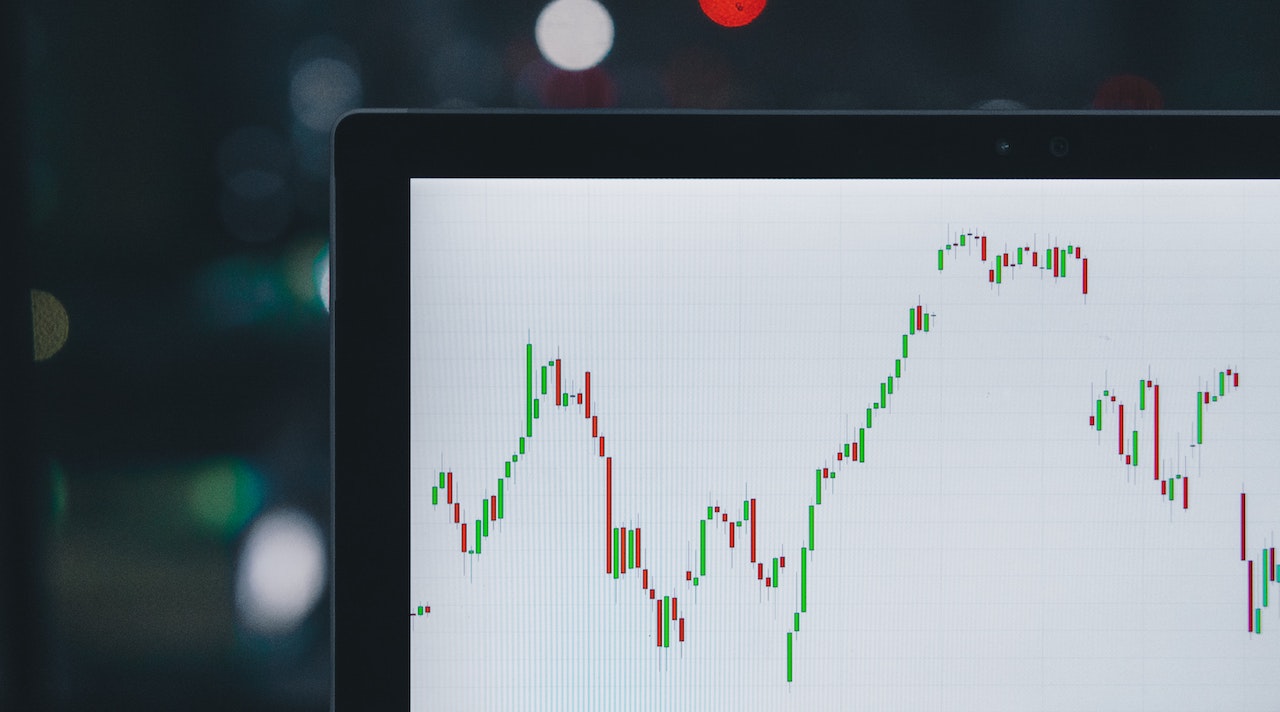

The Coronavirus has caused an extreme economic fallout that no one could have anticipated. Despite this, panic and anxiety aren’t solid solutions for the way forward. Although pandemics such as this are uncommon, the market’s known to follow a natural ebb and flow of volatility. With this in mind, it’s highly advised that investment managers come prepared.

As a financial advisor, part of your duty is to provide your clients with counsel through a volatile market. After all, this is most likely their retirement fund or children’s tuition you’re managing. These tips and tools will provide a framework for maintaining a solid client base, directing portfolios, and achieving investment objectives during turbulent times.

Strategies for Surviving Market Volatility

Volatility is inevitable in the investment industry – it will always make up a part of the financial market. These conditions can be caused by a myriad of factors, such as:

- economic growth

- inflation

- geopolitical events

- monetary policy

In addition to this, no one can predict how long these conditions can affect the investments either. Although short-term stresses can trigger anxiety, it’s important to be proactive in your investing strategy by combating these losses with long-term gains.

Be Proactive

In order to be proactive, understanding a client’s time horizon is key to assessing their tolerance for volatility. This time horizon should take into account when the client will need to access their money, and how much of it will be needed. For clients who are bucketing money, each bucket will need to be assessed and have its own risk profile.

Furthermore, it’s important to be proactive in terms of your clients’ expectations and needs. Should your clients have more conservative investment objectives, this should be taken into consideration when markets start to dip. This will help frame your next step forward.

Construct a Diversified Portfolio

Although predicting financial crises are beyond investment managers, producing a diversified portfolio is a winning way to mitigate the risk of losses. By reducing or balancing riskier investments with safer and lower-risk investments, a more stable investment portfolio can be achieved.

Through various investment vehicles, protection can easily be granted from concentrated risks in the market. With the right mix of investments, if one had to take a nosedive, the damage is therefore minimized through balanced assets. As a result, clients can stay comfortable enough to stay the course and mitigate against larger losses.

Ideally, a client’s portfolio should be balanced across the major asset classes. This can comprise of different weightings in equities (stocks), fixed income (bonds), cash and real estate. These four asset classes tend to perform differently based on various types of market volatility. Therefore, bad performance in one asset class may be offset by stronger performance in another.

Manage Client Expectations

Although the difference between volatility and risk may be clear to advisors, it’s essential that it’s apparent for clients too. This will assist in both portfolio and expectation management.

Volatility in the financial market refers to extreme and rapid price swings. This is what we’re experiencing in current times due to the COVID-19 pandemic. Risk, on the other hand, suggests the possibility of losing some or all of an investment.

As we’ve seen in the current market space, volatility can lead to either a profit potential or a risk of loss. For example, although stocks may decrease in value, this can pose to be the perfect time to invest. Outlining areas of opportunity and risk are key to seeing your clients through a volatile market environment.

Furthermore, it’s essential that, as an investment manager, that client’s emotions are well-managed too. As these are stressful times, it’s key to understand their worries and frustrations. Grounding your clients through guidance and insightful strategies can help manage their market emotions.

Highlight Potential Opportunities

While losing money is never easy to accept, a less than stable market environment can pose great opportunities for you and your clients. There are a number of strategies that offer alternative investments in times of uncertainty. Despite this being a short-term approach, financial advisors can make use of these options to lessen the loss of longer-term investments.

Making a tactical shift among asset classes can prove to be highly profitable. When stocks are down, this can be the perfect opportunity to diversify your portfolio into areas that would otherwise be too pricey. Moving carefully and predicting market behaviour may be the best way forward to ensure a successful short-term solution to your clients’ concerns.

However, with that being said, clients may be wary of investing during market volatility and its impact on their long-term goals. The truth is that avoiding investing all together can negatively impact their stocks too. A good investment plan is one that considers investing a set amount of money each month, especially in a bear market, is key. When prices are low, the potential for greater rewards down the line when prices rise is significant.

Stay Focused on the Plan

If past financial crashes and moments of prosperity have taught us anything, nothing lasts forever. For this reason, it’s essential that investment managers stick to their long-term place and have faith in its ability to do its job. The best strategy to guide clients through uncertain stocks is to highlight the importance of enduring any short-term fluctuations.

Before executing any new trades or adjustments, it’s vital that financial advisors remind their clients of their objective. This will assist in managing their expectations and seeing them through more profitable times.

Using Britech to Mitigate Risks in a Down Market

The largest downfall of being an investment manager is the uncertainty that comes with the financial market. With little to no control of events and trades, it’s hard to anticipate the correct approach to adapting your risk strategy. For this reason, we created our Pivolt Market Risk feature. Users can use our platform to instantly access updated market data, analyse their portfolios in real-time, and assess the exposure and sensitivity to various risk factors.

You can learn more about our solutions here. Alternatively, if you have any questions, please do not hesitate to get in touch.