Risk Evaluation

Assess market value at risk. Explore stress scenarios. Securely share with colleagues.

Full Visibility and Analysis to Market Risk

Full Visibility and Analysis to Market Risk

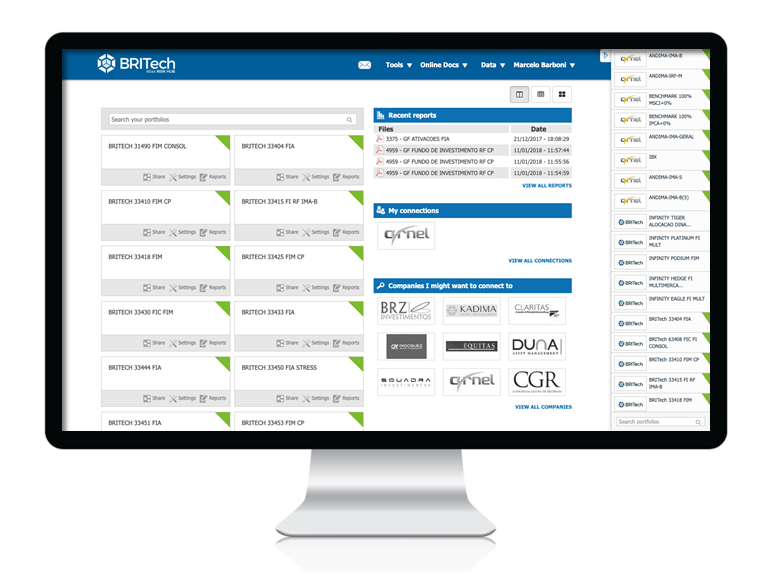

BRITech’s Risk Evaluation module includes a full suite of reporting, monitoring, and collaboration tools to fully explore risk and stress scenarios that help you help your clients achieve their goals while minimizing exposure. Assess market value at risk. Explore stress scenarios. Securely exchange information between advisors, allocators and fund managers. Explore simulations of real-time operations with exposure and sensitivity to various risk factors, customizable stress scenarios, benchmarking and tracking error.

SaaS Investment Management with a Difference

Explore the platform that brings efficiency, simplicity and flexibility

to front and back office operations

Leon Capital

“We recognize that BRITech had great knowledge and experience in the wealth management environment – which meant we would not have the same risk we had with our previous external vendor.”

Roberto Barba

Managing Partner

See the case